How Does Venmo Make Money? The Secret to Venmo’s Profit

When you buy something through one of the links on our site, we may earn an affiliate commission.

If you're like most people, you've used Venmo to send or receive payments at least once. But, I've got to ask - have you ever thought to yourself: how does Venmo make money?

Believe it or not, Venmo has a crafty business model, which keeps the cash flowing straight into their piggy bank.

They get revenue from various sources, such as:

- Transaction fees

- Interest on credit

- Debit card withdrawal fees

- Crypto

- Cashback partnerships

In this post, we will break down Venmo's top revenue streams. By the end, you'll be an expert on the business model that powers this popular payment app.

So grab a hot cup of joe, get comfy, and let's dive into the good stuff!

Contents

Venmo's Revenue Streams

Let's zoom in and closely examine Venmo's revenue streams.

Transaction or Interchange Fees

One of the primary ways Venmo brings in the dough is through transaction fees from merchants who accept it as a payment method.

Venmo charges merchants a 1.9% fee per transaction plus a fixed fee of $0.10.

Since this fee is a smidge lower than the fees charged by competitors like Square Cash (2.6% + $0.10) and Google Pay (2.9% + $0.30), Venmo remains an attractive option for businesses looking to accept mobile payments.

This revenue stream is a significant part of Venmo's business model, enabling the company to monetize its whopping user base of more than 83 million active users.

As Venmo's payment volume keeps climbing, the revenue from transaction fees is bound to follow suit.

Venmo Credit

Venmo's got another trick up its sleeve for generating revenue: Venmo Credit.

Venmo Credit is a premium credit card that grants users perks such as cashback on purchases and a credit score tracker.

Now, what's not to love about that?

There are no annual or foreign transaction fees, but let's not overlook the fine print – there's an interest rate.

That interest rate varies depending on your credit report, repayment history, and credit score.

According to the Federal Reserve, the average interest rate assessed to credit card account balances is 20.40%.

Also, US household credit card debt surpassed pre-pandemic highs of $927 billion (Federal Reserve Bank of New York).

Since credit card debt is on the rise, Venmo Credit has the potential to be a game-changer in revenue for the company.

Instant Transfers

Did you know Venmo has a convenient feature that lets you instantly transfer your Venmo balance to your linked bank account?

Bank transfers are notoriously slow and archaic, often taking days to complete. Also, banks charge extraordinary fees for interbank transfers.

Of course, nothing good comes for free, and Venmo charges a 1% fee for this speedy service.

But that's still a pretty sweet deal, with a minimum fee of $0.25 and a maximum of $10.

You must meet certain requirements, such as having a valid debit card, a verified bank account, and a good transaction history.

And there are limits, too - you can't transfer more than $2,000 per transfer, and there's a rolling 30-day limit of $5,000.

Debit Card Withdrawal Fees

Picture this: You're out for a night on the town, and you stumble upon a taco truck.

If you know anything about these culinary havens on wheels, then you know they only accept cash.

And if you're like most westerners, you're not holding any!

According to a recent survey, around 41% of Americans report that none of their purchases in a typical week are paid for using cash. Instead, they're utilizing cashless options like Venmo.

In this scenario, you whip out your trusty Venmo debit card to hit the closest ATM.

That's when Venmo charges a $2.50 fee for each out-of-network ATM withdrawal.

And if you opt for an over-the-counter withdrawal at a financial institution, Venmo slaps on a 3% fee.

Now, before you start hurling insults their way, let me remind you that Venmo also has some fantastic deals that can save you a ton of cash.

Crypto

You can buy, sell, and hold popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin all within the app. Venmo's foray into cryptocurrency is more than a way to stay trendy.

Nope, they're also making some serious cash by charging fees on crypto transactions.

Venmo charges a fee of 1.5% on all crypto transactions, which doesn't sound like a lot at first. However, it can add up quickly when considering the millions of Venmo users.

Given all the negative publicity in the crypto world, the small transaction fee is worth it for the convenience and security of using a trusted app.

Cashback Partnerships

Did you know that companies like Venmo earn money through their rewards program? It's counter-intuitive when you think about it.

But it's true – Venmo works with businesses to offer cashback deals for its users who shop at their stores or use their services.

When a Venmo user takes advantage of the deal, the merchant pays Venmo a commission.

And participating merchants get to attract more customers who want to join in the savings. So, it's a win-win for everyone involved.

According to Venmo, customers who use their debit cards can earn an average of $25 in monthly cashback rewards. It's like getting a free lunch every week, folks. Who wouldn't want that?

Participating in the Venmo cash-back program can also increase customer loyalty and repeat business for merchants.

Venmo reports that partner merchants see an average of 20% growth in customer spending.

Because of the program's success, partner merchants pay Venmo a fee to be part of it. So it's a great deal for both Venmo and the participating merchants.

How Does Venmo Work?

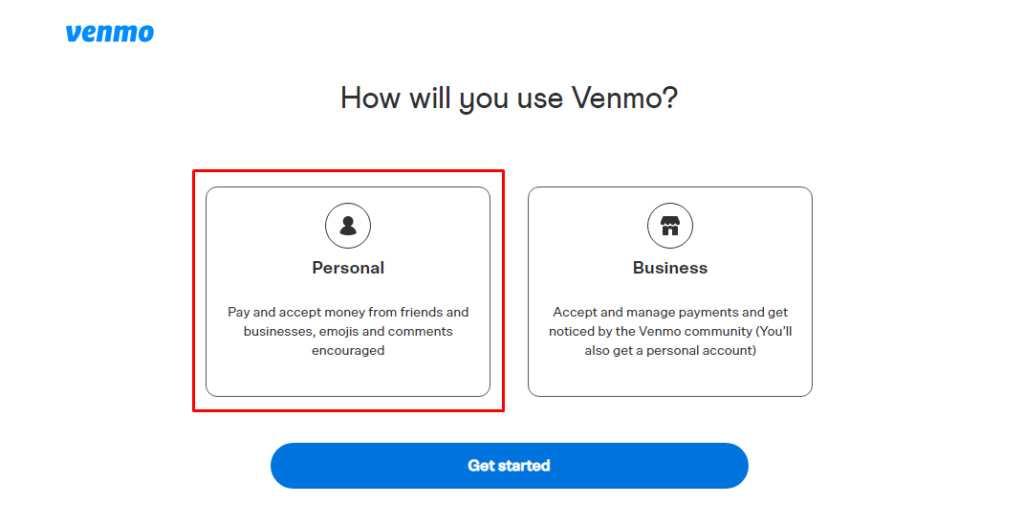

Two types of people use Venmo: personal and business users.

The first step for personal use is to download the app and link it to your bank account or debit card.

Then, you can send money to your contacts on your phone who also use Venmo. It's perfect for splitting bills with your pals, just type in the amount, throw in a brief description, and hit send.

If you're signing up on via your computer, select "Personal."

And get this - you can even request money from people who owe you. Take that, Steve!

Plus, there's a social component where you can like and comment on transactions.

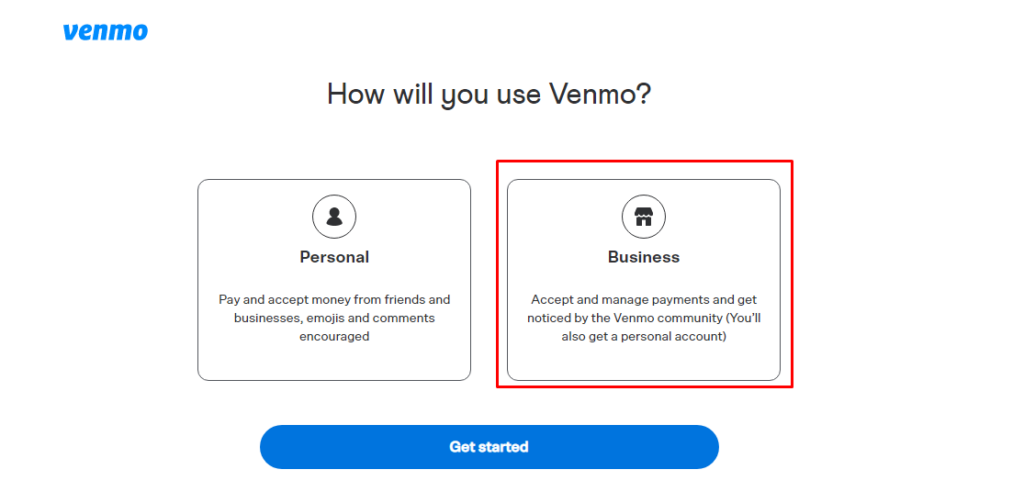

Folks who use Venmo for business will have to create a separate account.

For business owners, it's just as easy. Just head to Venmo's start page and sign up for a Venmo Business Profile. After you link your bank account, you can accept customer payments for your goods and services.

You can keep track of your business expenses and revenue in one place. It's like having a built-in accounting system. Just make sure to read Venmo's User Agreement to avoid any violations.

How Much Money Does Venmo Make?

In short, they make a lot!

Venmo's total payment volume has skyrocketed since its launch in 2012, with a staggering $244 billion in transactions in 2022 alone.

And with over 83 million users accessing Venmo once a year, it's no surprise that Venmo's payment volume continues to increase year after year.

According to Paypal's most recent quarterly earnings report, Venmo contributed to 18% of Paypal's overall total payment volume in 2022.

Challenges and Risks

Venmo is a top-rated payment app, but it also has its share of challenges and risks.

Competition

The fintech industry is cutthroat. Venmo faces competition from Zelle, Square, Google Pay, and Cash App (check out this article on how to make money on the Cash App) - they're all gunning for market dominance.

Venmo isn't content with mediocrity, so they're not just sitting on their hands.

They're constantly experimenting with different revenue models, like the crypto model we discussed earlier, which could help them stay ahead of the competition.

Venmo's parent company, PayPal, is looking into developing a stock trading app and other personal finance tools.

Jason Kupferberg referred to Venmo as a "super app" constantly improving.

It started primarily as a P2P platform, but today it's a digital wallet with "multiple monetization levers."

Security Concerns

As Venmo and other payment apps continue to gain popularity, many people are worried about the security of their financial information. That's a valid concern.

According to the FBI, the incidence of cybercrime is on the rise, as displayed in the graph below.

Over half of Venmo users, or 51%, are either very or somewhat concerned about their data security when using the app (Pew Research Center).

On top of that, 45% of users are worried about the possibility of unauthorized access to their accounts.

Some of the main concerns are fraud, scams, and the risk of hackers accessing sensitive financial information.

Despite Venmo's efforts to improve security, such as adding two-factor authentication and encryption, these concerns still pose a significant challenge for the app and the entire fintech industry.

Popular Fraud Schemes

Unfortunately, scammers are taking advantage of the app's convenience and users' trust to defraud them out of their hard-earned money.

These scammers are getting increasingly creative with their tactics, such as posing as a friend or family member in need or claiming that you've won a prize that requires an upfront fee.

Some even use Venmo's social feature to gain the trust of their victims before requesting a transaction.

So, how can you avoid falling victim to these scams?

- Never share your personal information or financial details with anyone on Venmo.

- Double-checking the recipient's username and transaction details is also a good idea before sending any money.

- Keep an eye on people "using your phone," such as when you've just met them and they're inserting their contact details.

If you're interested in learning more about how popular companies make money, check out:

FAQs

Here are some frequently asked questions about how Venmo makes money.

What is Venmo?

Venmo is a digital payment vehicle that allows users to send and receive money through the app. It draws funds from your linked bank account, then sends the money to the recipient of your choice. Braintree originally purchased Venmo for $26.2 million. Then Paypal acquired Braintree for $800 million.

Is Venmo Safe?

Yes, Venmo is absolutely safe. Venmo uses bank-grade security like encryption and two-factor authentication to protect user accounts.

What Are The Fees For Using Venmo?

- Instant Transfer Fees: This is 1.9% of the transfer amount. The minimum fee is $0.25, and the maximum is $10.

- Credit Card Fees: 3% of the transaction amount.

- Debit Card Withdrawal Fees: $1.25 per withdrawal.

- Bank Transfer (ACH) Fees: Free.

- Venmo Card Fees: There are no monthly or annual fees, but ATM fees may apply for out-of-network withdrawals.

- Crypto: Venmo charges a spread fee between the market price and the exchange rate. It also charges a transaction fee for buying or selling cryptocurrency. Therefore, the fee will vary.

Can I Use Venmo For Business Transactions?

Yes, Venmo offers a Business Profile service. This service allows you to accept payment in exchange for goods and services. Just make sure to comply with Venmo's User Agreement.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations