9 Important Tips To Help You Move Out at 18 & Thrive

When you buy something through one of the links on our site, we may earn an affiliate commission.

Are you ready for the freedom that comes with living in your own place? Many young adults aim to get out of their parents' house as soon as they can, but they may not be prepared for all that goes into the financial aspect of their newfound freedom. Learning how to move out at 18 is simple when you boil it down to a few basic principles.

If you're ready to move out as a young adult, here is what you need to know.

Contents

- Exactly How Much Money Do You Need?

- Make a Budget and Get a Bank Account

- Set up an Emergency Fund for Unexpected Expenses

- Find a Job (& Maybe a Side Hustle)

- Build Up a Good Credit Score

- Research Living Expenses and Plan for a Security Deposit

- Transfer Bills to Your Name

- Make Sure You Have Transportation Costs Covered

- Capitalize on Freebies

- Final Thoughts: How to Move Out at 18 the Right Way

Exactly How Much Money Do You Need?

Learning how to move out at 18 often means that you need a realistic picture of how much money is truly necessary to live on your own. Even if you try to do everything as cheaply as possible, you will still have to build a decent nest egg to get started.

Start with thinking about your housing situation. Most people without an excellent credit history (and you likely don't have much at 18) will be required to pay at least the first and last month's rent. Some places may also require a security deposit equal to one month's rent.

This alone could mean that you need upwards of $3,000 to get your first apartment.

Plus, you'll need furniture for your apartment and some food to stock your cabinets. In addition to transportation expenses and any credit card debt that you may have already acquired, it can really add up.

When determining how much money you need, a good rule of thumb is to have $5,000 saved up for your upcoming move. Not to mention, you'll need some money in your emergency fund as well (we'll cover this in a bit).

Money will be tight for a while when moving out at 18, but you can do it with a little planning and budgeting for your moving costs.

Make a Budget and Get a Bank Account

One of the first and most crucial things you need to do if you want to move out at 18 is to make a budget. A good budget should list all of your living expenses and monthly expenses ranging from rent to your Spotify subscription and everything in between. Even if it seems like a small expense, it belongs on the budget.

You can purchase a small notebook for this or do it digitally through Google Sheets.

The important thing is to keep up with how much you actually spend.

Not only do you need to know what your expenses are, but you also need to know where your money is going. Every penny that you spend should be tracked, even if your spending seems inconsequential.

Until you get a good handle on your finances, you might want to categorize your spending using popular apps like Mint or You Need a Budget. These apps help you to keep better tabs on where your money goes and spot places where you could save money.

This brings us to another point: you need to open a bank account in your name with a debit card. This is where your money and paychecks will be deposited, and it allows you to track your own spending.

Better yet, you should have both a checking and a savings account -- as we will see in the next point.

Set up an Emergency Fund for Unexpected Expenses

The truth is that you will eventually run into an emergency that requires some extra money. One study found that 57 percent of Americans can't afford a $1,000 expense. That could mean a hospital bill, new tires for your car, or something else that you can't foresee.

Setting up an emergency fund is essential for those who want to know how to move out at 18. You don't want to move out only to rely on your parents to bolster your bank account when trouble arises or your car breaks.

Your goal should be to save up at least $1,000 to start. With this accomplished, you can move on to saving three to six months of living expenses in your emergency fund.

You should also consider putting your cash in a high-yield savings account so that your hard-earned dollars can work a little harder on your behalf without ever having to lift a finger.

Find a Job (& Maybe a Side Hustle)

In order to cover your monthly living expenses, you need a steady source of income. Before you ever move out at 18, you should have a job lined up.

At 18 years old, you won't have the benefit of a college education behind you. This can seriously limit how you can earn money with a full-time job. You need to understand how to make the most money so that you have extra cash to contribute to that savings account.

This list of 40 real ways to make money without a college degree can help. You might also be able to use some of these 119 side hustle ideas.

You can also start a side hustle or online jobs that you can do in your spare time. One way to capitalize on spare time is to start a blog. The Affiliate Lab is an excellent way to learn SEO basics as well as writing fundamentals to get your website up and running.

You'll have an upfront investment of $700, but it could yield a great return on that investment.

You can also take on odd jobs like helping people to paint their homes, babysitting their kids, petsitting for the weekend, or becoming a food delivery driver. Make good use of all the spare time you have as an independent adult and start to rack up those savings.

Build Up a Good Credit Score

If you want to eventually qualify for loans to help you to buy a car or a house, you need to establish a good credit history. Your credit score is developed over time based on your payment history.

Reliably paying your bills on time will show up as a good credit score over time.

Credit doesn't start to get calculated until you turn 18, so you might have to get creative with how you build up this all-important score.

One of the best ways is to obtain a secured credit card where you will put down a deposit in exchange for a line of credit. Secured cards may one day transition to unsecured credit cards with a higher credit limit.

Keep in mind that credit is not the same as free money. You have to pay it back when the bill comes around. Over time, you might qualify for more money on an unsecured credit card as your credit score increases. A higher credit limit is a good thing as long as you don't rack up credit card debt.

You can also gain credit from things such as paying your cell phone bill on time or your rent, as long as you are the primary user on the account.

Research Living Expenses and Plan for a Security Deposit

Perhaps the biggest line item in your monthly budget is your rent. Most people who move out at 18 can't yet afford to buy their own house because they need a down payment and a good credit score. This lack of a credit score can also mean that you will owe more money when it comes to renting.

Affordable options are out there, but you might need to search for them.

Based on your credit report, you might have to pay a significant portion of your rent upfront. Many places require the first and last month's rent. This could add up to thousands of dollars in an upfront deposit before you can achieve financial freedom from your parents' house.

You might also find some apartments that are designated for low-income residents. These houses can help you to keep your money in your pocket instead of shelling out for more luxurious accommodation.

These housing costs are just the start of the expenses, though. You will still need to factor in your moving costs, such as boxes, U-Haul rental, and even your very first trip to the grocery store.

Transfer Bills to Your Name

There are many steps you need to follow if you want to know how to move out at 18, but one of the most important is to put your bills in your name. Think about all the bills that you may have contributed toward: car insurance, a cell phone bill, and even what you spent at the grocery shop.

You need to either put these bills in your own name or become an authorized user on these accounts.

This is a big deal because it serves two purposes. First, it establishes a bit of credit history for you, if you are able to pay these monthly expenses on time. Second, it allows you to make any changes that you want to the account as an authorized user.

While it may not be as good as getting free stuff from your parents, it teaches you responsibility and gives you the full feeling of being an adult with your own bills.

Make Sure You Have Transportation Costs Covered

If you want to make more money, the chances are that you will need to work more. The key to being a reliable employee is to have reliable transportation. For most people, this means they need their own car. If this isn't an option, then you may need to look into public transportation in your area.

A bus pass or subway fare can really add up over time, just like car insurance or the cost of gas.

If you intend to look for side hustles like being a food delivery driver for apps like UberEats, then you won't want to rely on public transportation.

In some cases, you might be able to have a parent cosign for you on a new-to-you car that can get you from point A to point B until your credit score increases. Otherwise, you might need to start working well in advance of turning 18 so that you can save money for a new car.

You don't want to have to put transportation expenses on a credit card, so start saving for these hidden expenses before you move out if necessary.

Capitalize on Freebies

If you truly want to save money and set a realistic budget, then you need to make use of freebies. Whether that means free clothes from friends who are upgrading their wardrobe or free gift cards from sites like Inbox Dollars, free stuff can save you tons of money on items that you might have better dedicated to other expenses.

View this as a way to earn a little extra money without having to work too hard.

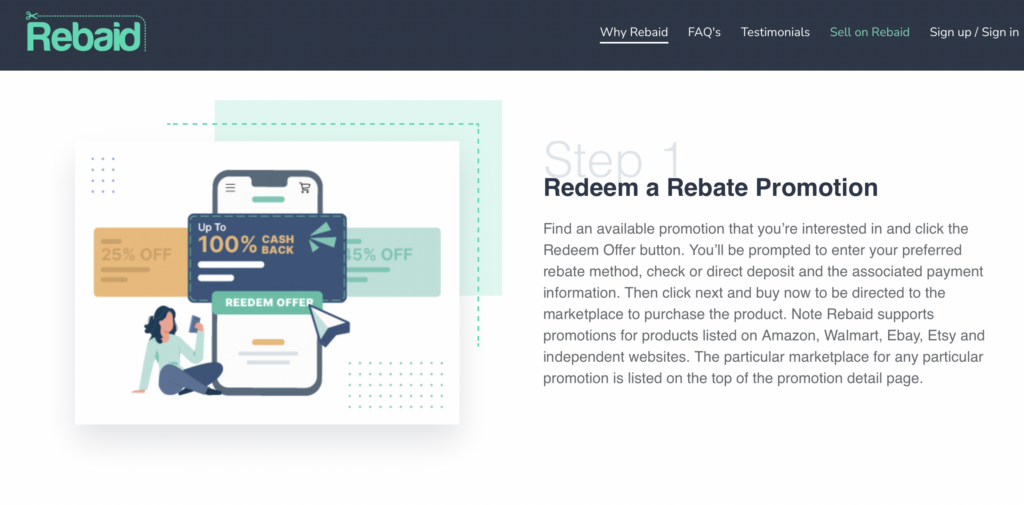

One great site to make use of free stuff that you might have already had access to at your parents' house is Rebaid. It allows you to net online rebates from shopping at places where you already spend a lot of money, like:

- Amazon

- eBay

- Etsy

- Walmart

Scoring your rebate is as simple as clicking a few buttons. You will clip the offer that you want, pay for your item, and let them know whether you would like a check or a direct deposit of your savings. Confirm that you actually made a purchase, and your rebate is sent to you in a matter of days.

On months when you are really hard up for cash when you move out at 18, you can take advantage of free meals at your parent's house or check for resources at your local food bank. There are lots of creative resources out there for you as an independent adult in a tough financial situation.

Final Thoughts: How to Move Out at 18 the Right Way

Moving out at 18 doesn't have to be a struggle if you know how to put the pieces together to get your financial plan in order. From securing your first apartment to building credit, these items are important to establish from a young age so that you can start to be independent of your parents.

If you need to know how to move out at 18, these 9 tips will help you to find permanent housing, earn enough money to pay your bills and other necessities and start setting you up for future financial success.

What do you need to do first to make moving out at 18 a reality for you?

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations